Senators submitted for consideration a bill to change tax reporting thresholds

Ever since news of changes to certain tax reporting thresholds broke last year, small online sellers have been angry, especially those who like to sell their old items online. For years, families in the United States have used websites such as eBay, Poshmark and Etsy to sell used items such as gently used clothing and unwanted antiques, as well as handmade goods. It has become a major source of income for people in certain situations. Stay-at-home moms, for example, used these sites to earn a little extra money.

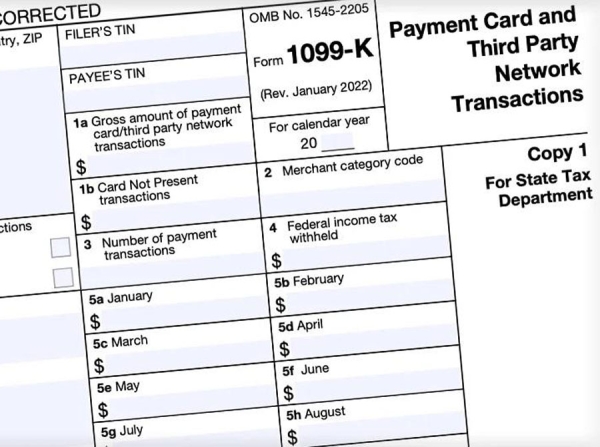

In 2021, a new law was introduced requiring marketplaces to report online marketplace transactions totaling more than $600, which is noticeably lower than the previous threshold of $20. Sellers must receive a Form 000-K reporting the amount of sales. The IRS explained that the change only affects tax reporting rules, and not the overall taxation of income, but despite this, many small sellers were unhappy, because if you submit used clothing, then what is the initial cost to indicate on the return?

A recent proposal gives hope for change again. U.S. Senators Sherrod Brown (D-Ohio) and Bill Cassidy (D-Louisiana) introduced legislation to cut red tape last Thursday, according to a press release. The bill proposes changing the reporting threshold from $600 to $10, meaning fewer sellers would receive tax forms from PayPal and other platforms. If this bill becomes law, many will breathe a sigh of relief.

Author: Elina Linderman