Personal taxes in the USA

A US tax resident is a person who is a US citizen, has permanent residence in the US, or spends more than 183 days per year in the US. The United States has a complex tax system that includes federal, state, and local taxes. Disclaimer: the USA has a progressive tax system: the more a person earns, the more interest he pays.

An employee under an employment contract pays:

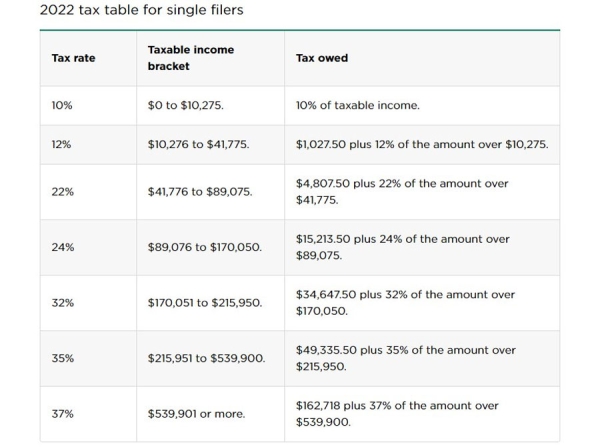

1.Federal Income tax (federal income tax) from 10% to 37%.

2.Social Security tax (tax to the social security fund) 6.2%.

3.Medicare tax (old age health insurance) 1.45%.

4.State tax (state tax) from 1% to 13.3%.

If you lived in Orlando, Kentucky and earned $55,000 in 2022, your total income tax rate would be $12,513 or 22.75%. You can check it yourself using a calculator.

Federal taxes include (2022 data):

-income tax (Federal Income Tax, rates vary from 10% (earnings up to $10,275 per year) to 37% (earnings from $539,901 per year)). Important – the tax percentage is not constant. With an income of $100.000, the tax rate is 24%, but this does not mean that $24.000 will be spent on taxes. In this case, $10,275 pays 10%, $31,500 pays 12%, $47,300 pays 22%, and only the remaining $10,925 pays 24%. The final tax instead of $24,000 will be $17,835;

-tax to the social security fund (Social Security Tax, rate 12,4%, paid 50/50 with the employer or 100% if self-employed);

- old-age health insurance (Medicare Tax, rate 2.9%, paid similarly 50/50 with the employer or 100% if self-employed). If an employee's income exceeds $200,000, then they will have to pay 0,9% more to the health insurance fund.

Non-residents in the US do not pay Social Security or Medicare taxes.

It is worth mentioning that in the United States there are 4 categories of federal income tax payers, for which different tax rates are established:

-

single taxpayer

-

spouses filing a joint return (not available to non-residents);

-

spouses filing separate returns;

-

head of household (not available to non-residents).

State income taxes range from 0% to 13,3%, depending on income level and state of residence. Local taxes can be set by the municipality (at the county level), regardless of the presence and amount of a state tax. All employed people (under an employment contract) pay all taxes and fees on each paycheck; more precisely, they are calculated and paid by the employer. Self-employed people (contractors, freelancers) are required to do this once a quarter or once a year on their own, because, from the point of view of the law, they are running a private business.

Source: Telegram channel “Immigration to the USA”